Nonprofit Bookkeeping Services Outsourced Bookkeeping

Content

![]()

This platform makes it easy to contact and work with expert freelancers in any financial field, so your nonprofit can improve its financial strategies. Whether you’re bookkeeping for nonprofits looking for a bookkeeper to help with invoicing and payroll or an accountant to help with tax preparation, you’ll find freelance experts ready to dive in and help.

Brown Schultz Sheridan & Fritz Announces Team Member … – Yahoo Finance

Brown Schultz Sheridan & Fritz Announces Team Member ….

Posted: Fri, 13 Jan 2023 08:00:00 GMT [source]

In addition, you’ll need to add around 20% on top of salary, for benefits and overhead, including office space. If you have the spare time to manage https://www.bookstime.com/ your work and some of the accounting each month but need a little extra help, a part-time bookkeeper might be a good solution for your Nonprofit.

Crowdfunding Resources

A. The income statement tells you if you are remaining cost-effective and shows your costs and expenses. It shows where you are spending your money and what sources your income is coming from. If you are not covering expenses, the Profit & Loss Statement can show you where you may be able to cut costs. Please complete the information request and one of our nonprofit advisors will be assigned to work with you. Please check your email to access their contact information and schedule.

What are the benefits of having an accountant for my non-profit organization?

The benefits of nonprofit accounting services include security, ability to monitor financial visibility and track grants, up to date compliance, quick data access, and so much more.

Therefore, having access to a knowledgeable individual to dive into these needs can be a valuable resource, especially if you have one very specific aspect of your strategy that you need assistance with. We love Paro because they’ll facilitate this matchmaking process to ensure your nonprofit has access to the right financial expert for your needs. A. After you sign up for the service, we will email you an order confirmation and service agreement. After you acknowledge this, we will forward you another email providing you access to our client-only web tools & questionnaire. Once you complete this online questionnaire, we will call you within 48 hrs to set up a conference call with your service consultant. During this call, the consultant will confirm information, ask you questions, answer any of your questions, and begin to work on your project. A. If your nonprofit is really small, you can manage it fine without creating a balance sheet each month.

NONPROFIT ACCOUNTING SERVICES

That helps us ensure your transactions are entered accurately and on time to give you confidence in your decisions. Then, we set up customized processes for your church to ensure all bills, payroll, and so on are correctly categorized. To access other member benefits and resources, log into NAO’s website using your NAO User Account information.

- These statements give you quality insights into how your organization performs, thereby helping board members take the necessary steps to understand where funds are being allocated to further the mission of the nonprofit.

- No matter how simple or complex your accounting needs may be, our professionals have the required experience to help your organization increase its effectiveness through professional bookkeeping support.

- Even tiny nonprofits have BIG bookkeeping challenges, like cash flow forecasting, grant tracking, and finding the time to reconcile your accounts.

- Setting these challenges aside and investing in best-in-class nonprofit bookkeeping can help ensure success, both now and long-term.

- As a nonprofit leader, you naturally want as much of your resources to go toward furthering your mission as possible, but of course, keeping a nonprofit’s operations in motion doesn’t just happen for free.

- If you decide to hire and manage a bookkeeper, you’ll also have to decide whether the position is part-time or requires a full-time, full-charge bookkeeper.

- Wheelchairs For Warriors is on a mission to help as many injured veterans as possible.

There are some guidelines to follow and our Albuquerque CPA firm, will guide you through rules and regulations and give you practical advice aboutNon-profit accounting best practices. Your nonprofit status brings with it responsibilities and obligations to demonstrate that the public funds and donations needed to run the organization are being used properly.

Part-Time Bookkeeping for Nonprofits

For efficiency and convenience, we urge all our clients to use QuickBooks™ online or a similar cloud-based solution. We can facilitate the data migration and train you in viewing reports using online accounting software. Our ongoing accounting and advisory services are year-round partnerships to keep your nonprofit’s finances healthy and relieve your stress. We do a paid data file review to assess the true nature of your financial records and the complexity of your business transactions and understand your expectations to determine the best outcomes.

The AICPA suggests that all nonprofits use certified public accountants for financial accountability. Paisley Solutions has been providing bookkeeping and payroll services for businesses in the Kennett Square, West Chester, Chadds Ford, Lancaster and Wilmington regions since 1996. CPA’s refer Paisley Solutions to non-profits and businesses in Chester County, Lancaster County and New Castle County. At Warren Averett, we understand the financial red tape that nonprofits have to address and sift through.

It’s time to fix your nonprofit’s accounting

Did you know that each year, 1 out of 3 businesses pays the penalty to the IRS and state authorities? With Goshen’s payroll service, you’ll never miss a tax deadline, and your data can be allocated to different projects, programs, and funding. Whether you are just starting out as a nonprofit or have been in business for 25+ years with remote and dispersed teams across multiple states, we handle all the payroll tax complexities. Supporting Strategies has allowed us to get out of our own way and focus on the long-term strategic financial-planning decisions we need to make. No matter where you’re at in your financial management, my services can be tailored to fit your needs and help build your capacity. GrowthForce accounting services provided through an alliance with SK CPA, PLLC. So, relying on them to operate the back office can lead to costly mistakes with tax filings and donation tracking.

- A. Accounting allows you to quickly determine your organization’s financial state, and whether you have adequate funding to cover costs.

- If you need a regulatory audit or other financial statement, please call us.

- For less than what it costs you to do it yourself or hire someone, Fontana Consulting PLLC can manage all or part of your accounting function.

- Without access to accurate financial reports and expert financial guidance, your organization will never be prepared for what’s coming next.

Our clients are provided a deeply-discounted subscription to the leading, cloud-based accounting software platform available, Quickbooks Online. You’ll have secure, 24/7 access to your books and records, from anywhere you have a broadband connection. Write and print checks, sync with your bank account, generate reports…it’s all there.

Resources

Get your accurate monthly reports to better direct your organization, financially. It is important to note, KatzAbosch was a founding firm of the Leading Edge Alliance , a global alliance of major independently-owned accounting and consulting firms in the United States, Asia, and Europe. Since its inception, we have become a leader within the organization by founding various subsets of the group and participating in LEA conferences.

Income Statement Definition, Guide & Template Example

Content

Finally, when it comes to income statements vs. balance sheets, there are a couple of clear differences. Whereas the income statement records your income and expenses, the balance sheet covers your business’s liabilities, assets, and equity. It’s also important to remember that income statements cover a specific period. In contrast, the balance sheet provides a snapshot of what Everything You Need To Know About The Income Statement your business owns and owes at a single point of time. It includes revenue, expenses, gains, losses, and the resulting net income from the period the statement covers. In other words, the income statement helps you to understand whether your business has made a profit or a loss. This can give you an excellent insight into your firm’s financial health over a given period.

When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out. Let’s look at each of the first three financial statements in more detail. A balance sheet shows you how much you have , how much you owe , and how much is remains . It’s a snapshot of your whole business as it stands at a specific point in time.

Calculate Net Income

This calculation tells you how much money shareholders would receive for each share of stock they own if the company distributed all of its net income for the period. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs.

What is an income statement?

An income statement shows a company’s revenue, expenses, and profits or losses over a period of time.

That’s the percentage of revenue for each line in the income statement. The sales revenue value is the total sales you’ve made during the year. The figure can be from anywhere between a day and up to a year – depending on how you calculate sales. To help you understand better, here’s a hypothetical income statement example.

Income Statements: Operating revenue

These days, there areaffordable, cloud-based accounting servicesfor every size business. Two income-statement-based indicators of profitability are net profit margin and gross profit margin. Operating expenses are the costs incurred to run the normal operations of your business. These expenses include inventory costs, insurance, rent, payroll, etc. Net income is the most important metric used by financial analysts to know the profitability of a business entity. When expenses exceed income, the net profit becomes negative, meaning you incur a net loss.

Naturally, you want to find out how your company is doing financially. Firms can calculate gross profit easier, as the difference between sales and cost of goods sold on the statement is necessary for the calculation. Revenue is the total money a company generates from its core https://online-accounting.net/ business, which involves selling the goods and services it produces. For both small and large businesses alike, financial reports serve several important purposes. These reports will be regularly utilized to evaluate the state of the company and chart the best path forward.

Statement #1: The income statement

However, scaling operations becomes extremely difficult if you don’t have historical information on your earnings, losses, and trends. It’s essential to include a projected income statement in your business plan. An income statement or a profit and loss statement helps to understand a company’s sources of revenue and various items of expenses. In other words, it tells you where the money is coming from and where it’s going. A glance at the income statement can tell anyone whether the business is profitable. Basically, an income statement lists out various items and amounts of revenue and expenses, with the net profit figure at the bottom. Expenses represent the value of the resources used to create the product or service provided to customers.

Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. When the stock market boomed in the 1920s, investors essentially had to fly blind in deciding which companies were sound investments because, at the time, most businesses had no legal obligation to reveal their finances. After the 1929 market crash, the government enacted legislation to help prevent a repeat disaster. To this day these reforms require publicly traded companies to regularly disclose certain details about their operations and financial position. Interested in learning more about all important financial statements? Check out our brief read What Are the Five Types of Financial Statements And How to Understand Them, or ZarMoney’s detailed guide with examples The Types Of Financial Statements And Why Each Is Important here.

If your total expenses outweigh your revenue, your net income will be in the negative. For lean startups still fine-tuning their technology and attracting venture capital, temporarily operating at a loss may not be a bad thing. Depreciation expenses are reported like any other normal business expense on your income statement, but where you include it depends on the nature of the asset being depreciated. Gross profit tells you your business’s profitability after considering direct costs but before accounting for overhead costs.

Multi-step income statements separate operational revenues and expenses from non-operating ones. They’re a little more complicated but can be useful to get a better picture of how core business activities are driving profits.

I don’t have a farm How do I delete Schedule F?

Farmers need only make one estimated tax payment per year under some circumstances rather than the four that other sole proprietors are required to make. IRS penalties won’t kick in if you make just one payment, but there are rules. Qualifying as a farmer doesn’t just mean that you grow crops.

- If you make this election (or made the election in a prior year), report loan proceeds you received in 2023 on line 5a.

- With the start of the 2024 filing season, the IRS will be extending hours of service in nearly 250 Taxpayer Assistance Centers (TACs) across the country, providing additional help to people.

- Your short-term capital gains are taxed at the same rate as your other income, but your long-term gains are taxed at lower rates.

- Additional property placed in service in 2023 may qualify for the special depreciation allowance.

Any change in your reporting position will be treated as a conversion of the entity. You can deduct the costs you incur that are an ordinary and necessary expense of farming on Schedule F to reduce the profit—or increase the loss—on which you’ll owe taxes. If you are self-employed, it’s likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business.

You must also report income from other sources in addition to your farming income on your Schedule F, such as federal disaster payments and money received from agricultural programs. Most agricultural programs will report income paid to you on Form 1099-G, a copy of which will be mailed to you. You and your spouse wholly own your unincorporated farming business as community property. You can then be treated as a sole proprietorship instead of a partnership and file Schedule F. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. As with all businesses, the IRS requires you to report the income and expenses involved with running that business, including a farm rental.

Profit or Loss From Farming

For details and exceptions to these rules, see chapter 4 of Pub. Enter on line 6d the amount, if any, of crop insurance proceeds you received in 2022 and elected to include in income for 2023. In most cases, you don’t report CCC loan proceeds as income. However, if you pledge part or all of your production to secure a CCC loan, you can elect to report the loan proceeds as income in the year you receive them. If you make this election (or made the election in a prior year), report loan proceeds you received in 2023 on line 5a. Attach a statement to your return showing the details of the loan(s).

Freelancers, contractors, side-giggers and small business owners typically attach this profit or loss schedule to their Form 1040 tax return when filing their taxes. Taxpayers who are using a tax software product for the first time will need their adjusted gross income from their 2022 tax return to file electronically. Review these steps to validate and sign an electronically filed return. Taxpayers can visit IRS.gov 24 hours a day to get answers to tax questions.

Is TurboTax ever on sale?

Don’t include as income on line 3b patronage dividends from buying personal or family items, capital assets, or depreciable assets. Because you don’t report patronage dividends from these items as income, you must subtract the amount of the dividend from the cost or other basis of these items. If you sold livestock because of drought, flood, or other weather-related conditions, you can elect to report the income from the sale in the year after the year of sale if all of the following apply.

Get More With These Free Tax Calculators And Money

Users get anytime assistance from TurboTax’s online community of TurboTax specialists. TurboTax Free Edition includes guidance in case of an audit, backed by TurboTax’s audit support guarantee. For example, https://turbo-tax.org/ if you work in an office setting, expenses like office furniture, supplies, software, and computer hardware are likely all ordinary and necessary expenses you’d expect to pay in your line of work.

Talk with a financial advisor if your farm hasn’t made a profit in several years. A professional can help ensure that you can successfully demonstrate that your farm is a business rather than a hobby. The time and effort you put into farming are substantial. Let’s say for the 2023 tax year (filing for 2024), you earned a taxable income of $90,000, and you filed as single. Based on the tax brackets, you’ll fall under the third tax bracket for taxable incomes between $44,725 and $95,375, which has a tax rate of 22%.

She firmly believes that it can make the crispiest sweet potato fries.

555 for more information about community property laws. For 2023, Schedule F (Form 1040) is available to be filed with Form 1040-SS, if applicable. For additional information, see the Instructions for Form 1040-SS. For the latest information about developments related to Schedule F (Form 1040) and its instructions, such as legislation enacted after they were published, go to IRS.gov/ScheduleF. A procedural vote to begin debate on a national security bill that included border security measures and foreign aid was 49 in favor to 50 against, falling short of the 60-vote threshold needed to advance in the Senate. TurboTax Deluxe includes one-on-one support from live TurboTax product specialists.

225 for exceptions, inventory methods, how to change methods of accounting, and rules that require certain costs to be capitalized or included in inventory. You may be able to elect to use a de minimis safe harbor to deduct amounts paid for certain tangible real or personal property used in your farming business. If you elect the de minimis safe harbor for the tax year, enter the total amounts you paid for property qualifying under the de minimis safe harbor on line 32.

If you itemize, we’ll automatically fill out Schedule A, Itemized Deductions. Arnold Schwarzenegger is back for another action role, this time as “Agent State Farm” in the insurance company’s Super Bowl campaign. Actor Chris Pratt transforms into the turbo tax schedule f mustachioed mascot of Pringles in the chip company’s Super Bowl ad. These extra hours are in addition to the IRS opening or reopening 50 Taxpayer Assistance Centers that have occurred since Inflation Reduction Act funding became available in 2022.

If you provided taxable fringe benefits to your employees, such as personal use of a car, don’t include in farm labor the amounts you depreciated or deducted elsewhere. Contributions you made on your behalf as a self-employed person to an accident and health plan or for group-term life insurance aren’t deductible on Schedule F (Form 1040). However, you may be able to deduct on Schedule 1 (Form 1040), line 17, the amount you paid for health insurance on behalf of yourself, your spouse, and your dependent(s) even if you don’t itemize your deductions. See the instructions for Schedule 1 (Form 1040), line 17, for details. Deduct contributions to employee benefit programs that aren’t an incidental part of a pension or profit-sharing plan included on line 23. Examples are accident and health plans, group-term life insurance, and dependent care assistance programs.

If you made contributions on your behalf as a self-employed person to a dependent care assistance program, complete Form 2441, Parts I and III, to figure your deductible contributions to that program. In the case of a partnership or S corporation, the election must be made by the partner, shareholder, or member. This election can’t be made by tax shelters, farming syndicates, partnerships, or corporations required to use the accrual method of accounting under section 447 or 448(a)(3).

Home & Business

Use this tool to look up when your individual tax forms will be available in TurboTax. You can search by TurboTax product and for IRS or state-specific forms. The IRS lets you take either the Standard Deduction or the itemized deduction.

Gates 91024 Alternator Pulley Tool Kit Vehicle Custom Fit

The Gates ADP Tool Kit contains all of the tools required for ADP removal and installation. This handy tool kit includes eight tools designed to R & R all vehicles that utilize ADPs found on the road today. One kit eliminates the need to shop around for hard-to-find tools and reduces service bay downtime that can take a toll on dealer profits. The Gates ADP Tool Kit includes all of the tools required for ADP removal and installation. This handy Tool Kit includes eight tools designed to R & R all vehicles that utilize ADPs found on the road today.

- This handy tool kit includes eight tools designed to R & R all vehicles that utilize ADPs found on the road today.

- Gates® is the world’s leading manufacturer of power transmission belts and a premier global manufacturer of fluid power products.

- Some states do not allow the exclusion or limitation of incidental or consequential damages, and some states do not allow limitations on how long an implied warranty lasts, so the above limitation and exclusion may not apply to you.

- Goods are not warranted to comply with laws that may apply to uses of the Goods not stated in related materials, e.g., use in manned or unmanned aviation or life support applications.

Goods are not warranted to comply with laws that may apply to uses of the Goods not stated in related materials, e.g., use in manned or unmanned aviation or life support applications. Gates® is the world’s leading manufacturer of power transmission belts https://adprun.net/ and a premier global manufacturer of fluid power products. Brand’s highly engineered products are critical components used in diverse industrial and automotive applications where the cost of failure is very high relative to the cost of their products.

Gates 91024 Alternator Pulley Tool Kit

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Goods are warranted to be free from defects in material or workmanship for the life of the Goods (or the published recommended replacement interval specified by Gates). Gates will replace or repair, at its option, any Goods proved defective in material or workmanship during the warranty period. This warranty is void if the defect is caused by improper installation, use or maintenance of the Goods, or used for racing or competition.

Gates Tool Kit

All other warranties, express or implied, including, but not limited to warranties of merchantability and fitness for a particular purpose, are expressly disclaimed. Failure to replace timing belts or other gates products as specified may result in catastrophic engine or equipment damage, for which gates disclaims all responsibility, to the extent permitted by applicable law. Some states do not allow gates 91024 adp tool kit the exclusion or limitation of incidental or consequential damages, and some states do not allow limitations on how long an implied warranty lasts, so the above limitation and exclusion may not apply to you. This warranty gives you specific legal rights, and you may also have other rights which vary from state to state. This website is using a security service to protect itself from online attacks.

Square Payroll VS Gusto Comparison 2023: Which Is Best?

Contents:

New and small bookkeeper definitiones that do not have a great deal of experience or confidence with payroll, benefits and HR compliance. Gusto supports health benefits in 37 states and the District of Columbia. It does not currently offer health plans in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia or Wyoming. If you run your company’s payroll through Gusto, it will create W-2 forms for all employees paid during the year. Gusto will create the forms and send them to all required parties, including your employees. Gusto is perfect for business owners seeking to maximize automation and efficiency in their processes.

The limited employee management features and restrictive pricing may make running your business more challenging instead of less. Paycor has four plans for small businesses and custom pricing for companies with more than 50 employees. Although Zenefits is primarily a benefits administration software , they also have payroll and HR tools.

Who is Gusto best for?

Gusto takes care of calculating and filing payroll taxes for you and your employees, and it keeps a record of pay stubs accessible to employees through their online profiles. Employees also get an email each payday letting them know their money’s coming in. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

The Gusto features large 12 inch tyres that vouch firmness even at high-speeds. These tubeless tyres not just provide stability on road but they are also vital from the point of view of safety. The feature rich Gusto gets some of the segment best fitments absent in arch rivals such as Activa, Jupiter and Maestro. Frankly, Jupiter is the only model that gets tubeless tyres and telescopic suspensions with air springs, besides these features the model is bereft of rest of the above mentioned equipment.

Paying Contractors and Counting Hours With Gusto

Gusto simply doesn’t offer any meaningful recruiting features, so consider your talent acquisition strategy carefully when evaluating this platform for HR. One of the platform’s HR shortcomings is its lack of talent acquisition features. Gusto’s support starts with the job offer letter, so you’ll need to use another strategy throughout the recruiting process. Then there is workers’ compensation, health reimbursement – an alternative to traditional health insurance – and commuter benefits.

Gusto vs OnPay: Which Is Best for Your Business in 2023? – TechRepublic

Gusto vs OnPay: Which Is Best for Your Business in 2023?.

Posted: Mon, 06 Feb 2023 08:00:00 GMT [source]

So, anyone you hire for HR, accounting or bookkeeping can get the information they need without going through you. Gusto files employee W-4s and contractor W-9s as part of their profile setup, and it creates and distributes W-2 and 1099 forms each January for tax returns. You can also elect to have Gusto automatically file a new hire report in an employee’s state when you hire them.

Gusto Ease of Use

Dental and optical benefits, commuter benefits, and paycheck splitting can all be created and governed through Gusto. Some of these cost nothing, while others are listed as “low-cost” or “premium,” but you won’t have to worry about knowing what you need before you need it, as these can always be added at any time. Users on Premium will also be able to carry out anonymous and customizable team surveys to gain insights into their employees. As you can see, this tier manages far more than payroll and acts more as a one-size-fits-all HR and accountancy tool.

- When they get paid, Homebase automatically deducts the same amount from their paycheck.

- They’re not too complex for small teams to manage, and they both balance functionality and cost.

- Gusto has job offer letter templates in its lowest cost plan and introduces job posting and applicant tracking in the next tier up.

Where the two software apps diverge, however, is in benefits options. For example, Gusto offers thousands of health plans, whereas Square partners with SimplyInsured for health benefits. If your benefits exist outside the scope of Square and its partners, you’ll have to do more work to calculate deductions yourself.

https://1investing.in/ takes care of deductions, and automatically files payroll taxes. Gusto’s recruiting features allow hiring teams to transition candidates who have accepted offers into the onboarding process. Plus, having these tools connected provides HR with more comprehensive analytics and insights about how to improve the hiring process. Employee time tracking is included in all Zenefits plans and syncs with the HR, benefits, and payroll modules.

Paylocity: Best for employee experience

This company’s software is used by more than 100,000 companies nationwide and it has offices in San Francisco, Denver, and New York. Gusto will also automatically file and send out their 1099s at the end of the year at no additional charge. Companies with employees in multiple states will need to enroll in the Plus or Premium plan to gain access to multistate payroll functionality.

Gusto Vs. Zenefits (2023 Comparison) – Forbes Advisor – Forbes

Gusto Vs. Zenefits (2023 Comparison) – Forbes Advisor.

Posted: Tue, 03 Jan 2023 08:00:00 GMT [source]

Processing payroll is the easy part—it’s the setup and ongoing maintenance of pay items and employee information that’s hard. Gusto is not a health insurance company, but can help you manage your employee health insurance benefits. You can offer the same health insurance you offer now with Gusto, or Gusto can act as your broker to find you new options. Gusto is designed with dynamic startups and growing small businesses in mind. In addition to smooth integration, your Gusto account could get you discounts on some popular apps. For example, at the time of this writing, it’s offering three months free to restaurant scheduling software 7shifts, 25% off Breezy HR plans and many more.

Both of these applications, designed for small businesses, offer similar features and functionality, and both will get the job done. RUN Powered by ADP is designed for small businesses with between 1 and 49 employees, with all RUN plans designed for that demographic. A vertical menu bar to the left of the main screen provides easy access to all Gusto features, including quick access to the Gusto Help Center.

Keep in mind that this doesn’t support W2 workers, just 1099 contractors, so you won’t be able to pay standard employees if you’re only using the Contractor plan. Since the package only offers custom pricing, you’d expect the Concierge plan to be the absolute final frontier of payroll software – you’d be just about right, too. Gusto can help new employees who will be in need of W-4 and I-9 forms by creating and aiding with the filling out of these forms.

The software empowers employees to take control of their own onboarding process without needing to reach out to HR every step of the way. HR administrators can monitor new employees’ progress to ensure all tasks are completed in a timely manner. In terms of similarities, Gusto and Zenefits provide customizable templates for key documents in the onboarding process, such as confidentiality agreements and direct deposit forms. With both vendors, new employees can sign documents digitally, and HR teams can set up automatic app provisioning for third-party tools like Slack and Google Workspace. Zenefits offers payroll as an add-on module for its all-in-one HR platform or as a standalone product. This provides customers the flexibility of using existing payroll software while benefiting from the rest of the Zenefits platform.

Gusto’s Premium plan supports performance reviews, which include both one-on-ones with managers and self-evaluations. You can create and automate review cycles, as well as track team members’ progress over the year. And when it’s time for someone’s assessment, either you or the employee in question can fill in customizable forms about their strengths and areas of growth.

Benefit Resource ADP Marketplace

Software companies are pivotal to businesses day to day operations across many different industries. The market opportunities in generative AI also present a compelling reason to invest for the long term. These 3 software companies stand out as promising candidates to potentially double your investment within the next 24 months. Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

- Health Savings Accounts (HSAs) allow individuals who are covered by an HSA-compatible health plan, including HDHPs, to save money to pay for eligible medical expenses on a tax-free basis.

- A health care FSA can be useful for people with any level of health costs.

- These 3 software companies stand out as promising candidates to potentially double your investment within the next 24 months.

Additionally, Intuit’s new generative AI assistant is set to increase workflows and automated tasks for customers. Use the HSA Bank Eligibility List to find out what types of facilities are covered for dependent care services so you can decide how much to put into the FSA. When the year ends or the grace period expires, any funds that remain in your FSA are lost. Thus, you should carefully calibrate the amount of money you plan to put into your account and how you intend to spend it over the course of the year. Besides their tax benefits, FSAs offer several advantages for account holders, but they don’t cover all manner of medical or dental expenses. Dependent care FSAs are useful if you’re paying for care for a child or dependent adult while you work.

Depending on your benefit plan, your employer may contribute to your FSA as well. Cloud infrastructure revenue saw 52% growth, as cloud service demand rises at an unprecedented level. It is rising so fast that Oracle is building 100 new cloud data centers around the world. Oracle is a pure play software bet on the growing demand for artificial intelligence.

Our Company

Management remains bullish on the outlook for FY24, and that has already been showcased in the first quarter. EPS increased 11% to $2.08 per share, with adjusted EBITDA margin up 10 basis points to 24.2%. Looking out to the full year, CEO Maria Black remains bullish on their ability to continue driving profitable growth. They expect revenue growth of 6-7%, with EPS growth between 10-12%. Depending on how the second quarter pans out, management could raise FY24 guidance making ADP stock a buy. Use the HSA Bank Eligibility List to find out if an item or service is covered.

How Much Should I Contribute to My FSA?

No specific amount is correct for everyone, and FSA elections vary depending on each indidvidual’s particular situation. Make your election by carefully examining your expected out-of-pocket healthcare expenses for the coming year. If you are married, your spouse also can put aside up to the annual contribution limit through their employer.

Can I Use an FSA with a Health Insurance Marketplace High-Deductible Plan?

With a forward PE of 20 and P/S ratio of 6, this is one of the cheapest AI software stocks to buy for 2024. Intuit stock has far outpaced the market, and has delivered 25% in compounded annual returns over the last 5 years. Their branded software products include Intuit Assist, Turbo Tax, Credit Karma, QuickBooks and Mailchimp. They have continued to see strong double digit growth in operating income, reflected in their recent Q1 FY24 financial results.

The services are provided by an independent third party and not provided by ADP and ADP is not responsible for such third party’s products or services. Many or all of the products featured here are from our https://adprun.net/ partners who compensate us. This influences which products we write about and where and how the product appears on a page. We believe everyone should be able to make financial decisions with confidence.

With both dependent care and health care FSAs, employers can offer a grace period of 2.5 months into the following year to spend any leftover funds. With a health care FSA only, employers can allow you to carry over up to $570 from 2022 to the following year. Employers can offer either option for a health care FSA, but not both. Flexible Spending Accounts, or FSAs, let you keep a bigger portion of your paycheck, and earmark some of that money for health care or dependent care expenses.

A Health Reimbursement Account (HRA) is an employer-funded account designed to assist employees in paying for certain out-of-pocket medical expenses. A dependent-care FSA has different maximum contribution rules than a medical-related FSA. A flexible spending account, or FSA, is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. A different type of FSA—a “limited purpose flexible spending arrangement” (LPFSA)—refers to a savings plan that can be used with a health savings account (HSA), which isn’t allowed for a standard FSA. A Flexible Spending Account (FSA) can save employees up to 40% on expenses they already pay for.

A health care FSA can be useful for people with any level of health costs. If you have predictable, ongoing medical expenses during the year, or regular over-the-counter spending, using pretax dollars for those costs lowers adp fsa your bottom line. Instead, you can set up a similar product, called a Health Savings Account (HSA). These let you to set aside money on a pretax basis to pay some health expenses if you have this type of health insurance.

Help your people make the most of their benefits

To use funds for your dependents, they must be claimed on your tax return, and dependents can’t file their own return. A flexible spending account (FSA) is a type of savings account that provides the account holder with specific tax advantages. An FSA is sometimes called a “flexible spending arrangement” and can be established by an employer for employees. FSAs are “use or lose,” meaning the amount in your account will expire at the end of the year. However, employers do have options to prevent employees from losing any funds remaining at year’s end.

For example, you could use funds for dental or vision care (including copays), plus a wide variety of over-the-counter items. To decide if an FSA is right for you, take stock of your health and dependent care spending. If you have any ongoing or expected medical needs you might have to pay for in the upcoming year, an FSA is a great use of your money. The funds can also be used for over-the-counter items such as allergy and sinus drugs, first-aid supplies, digestive health products and home COVID-19 tests. A dependent care FSA can be used for day care and preschool expenses, but also for things like summer day camp and after-school programs. You can use funds from your healthcare FSA to pay for eligible medical costs for both your spouse and tax dependents, regardless of the medical insurance in which they are enrolled.

POS Meaning: What Does POS Mean?

POS systems are not generally used for marketing, but can analyze the results of marketing endeavors based on real-time sales reports. The POP refers broadly to the physical or online location where a purchase is about to be, or could be, made. The POP is defined from the customer’s point of view and can be evaluated or referred to from several different perspectives.

- POS stands for “Parent Over Shoulder.” It is used to alert the other person that their parent or guardian is nearby, and they should be careful with what they say.

- This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

- Basic systems include an electronic cash register and software to coordinate data collected from daily purchases.

- Through a narrower lens, POP can also be used to describe the exact products being offered by a business at any one time.

- He remains most at home on a tractor, but has learned that opportunity is where he finds it and discomfort is more interesting than complacency.

- The point of purchase refers to the shopping experience from the customer’s, or the consumer’s, point of view.

At its broadest definition, the POP can encompass the entirety of the store and everything within, as well as anything placed outside to attract customers. Products, displays, organization of the store and anything that may incentivize a consumer to make a purchase can all be part of the POP. In general, the goal of POP marketing is to entice impulse buys, attract customers and even help create an image or brand for the store.

While both acronyms are used in conversations, they are used in very different ways. Gaming chats have also started incorporating POS systems to allow gamers to purchase in-game items and currency. These POS systems are designed to be quick and easy to use, providing gamers with a hassle-free way to make purchases without leaving the game. In a vastly changing world, you need to learn and understand how to use acronyms and abbreviations in the right way to avoid confusion and miscommunication. Since the coming of cell phones, communicating became more leisurely, and in recent years, texting has become all the rave, especially among the teens and the youth. There are a lot of acronyms that are used in texting and we’ll examine the meaning of POS today.

Point of Sale

Customers can also interact directly with POS systems, particularly in the hospitality industry. Often referred to as location-based technology, these systems can process transactions at customer locations. For example, at many restaurants, customers can view menus and place orders on terminals located at their table.

POS Meaning: What Does POS Mean?

These include counter display units, freestanding display units, standees, display stands, display packs and strut cards. POP can refer to the entirety of the store or any of the displays and advertisements scattered throughout. Note that there is some overlap here depending on your perspective, since there are often plenty of POP displays on, around or on the way to the checkout counter.

In medical terminology, POS can refer to “Place of Service.” This is a code used to indicate where a healthcare service was provided, such as a hospital, clinic, or doctor’s office. Overall, while POS may be a convenient abbreviation in certain contexts, it is important to be mindful of its potential negative connotations and use it appropriately.

POS can also refer to the point-of-sale system or the specific technology used to process any sales made. POS systems can be universal too; one excellent example of a global POS system is the common barcode, which can be read by machines all over the world. These POS systems also provide businesses with the ability to manage their inventory, track sales, and accept different payment methods. Depending on the software features, retailers pos acronym can track pricing accuracy, inventory changes, gross revenue, and sales patterns. Using integrated technology to track data helps retailers catch discrepancies in pricing or cash flow that could lead to profit loss or interrupt sales. POS systems that monitor inventory and buying trends can help retailers avoid customer service issues, such as out-of-stock sales, and tailor purchasing and marketing to consumer behavior.

POS Variations in Different Platforms

Point-of-sale (POS) usage refers to the utilization of any POS system for your business. At their simplest, POS systems allow you to perform transactions and process payments—with a cash register and a scanner, for example. Other POS systems feature software that allows you to manage inventory and run analytics across multiple stores or between websites and physical locations. This includes tech like card readers, scanners and barcodes, as well as the system’s ability to do inventory management and payment processing.

For example, many retailers use POS systems to manage membership programs that award points to frequent buyers and issue discounts on future purchases. For example, department stores often have POSs for individual product groups, such as appliances, electronics, and apparel. The designated staff can actively promote products and guide consumers through purchase decisions rather than simply processing transactions. Similarly, the format of a POS can affect profit or buying behavior, as this gives consumers flexible options for making a purchase.

British Dictionary definitions for pos. (2 of

POS systems can be cloud-based, such as purchases made in apps, or traditional, such as a computer and scanner system at the checkout counter for a grocery store. Mastery of both point of purchase and point of sale is essential if you want to have a successful business. As a business owner, you need to have a functioning POS system in order to process transactions and manage your store. You also need to understand the POP and how it affects your customers since, otherwise, you may struggle to make a sale.

At its broadest definition, the POP can include the entirety of the store, up to and including any items that are featured in the windows and the way that products are displayed, ordered and arranged. Through a narrower lens, POP can also be used to describe the exact products being offered by a business at any one time. A good example of both perspectives is a grocery store and, less broadly, a carton of milk in the dairy aisle. Social media platforms have become a popular place for businesses to sell their products and services. With this, social media platforms have integrated POS systems to make it easier for businesses to sell products and receive payments directly from their social media accounts.

Understanding POS

All of these features result in a centralized system for sale management, eliminating many of the headaches that come with a more out-of-date accounting software. Keep in mind that POS software is typically designed to meet specific needs, meaning that the best POS system for a retail store may not be the best system for a restaurant. Some are more common than others, and some have multiple meanings depending on the context. In this section, we will compare POS with some other commonly used chat acronyms. POS is still commonly used in chat platforms today, particularly among younger users who are concerned about their parents monitoring their online activity. It’s often used as a warning to let the other person know that they should be careful about what they say or do.

All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. POS, on the other hand, is used to express negative emotions https://business-accounting.net/ like disappointment or frustration. While both acronyms are used to convey emotions, they are used in very different contexts. POS stands for “Point of Sale.” It refers to the location where a transaction takes place, typically a retail store or restaurant. BRB stands for “be right back,” and it is used to indicate that the person is stepping away from the conversation temporarily.

What Are The Generally Accepted Accounting Principles?

Content

According to the Companies Act, the contents of the Balance Sheet and Profit & Loss Account are to be disclosed. According to this principle, both revenue and expenditure must be recorded in the actual incurred instead of at the time when the cash or cash equivalent is received or spent. Irrespective of the successive cash flow, income and expenditure are significant. U.S. GAAP means United States generally accepted accounting principles.

- GAAP are a stringent set of rules that rarely capture the complexity of modern business.

- These standards are also useful in determining how the transactions and other accounting events should be reported in the financial statements.

- Non-GAAP numbers also include pro forma figures; these fail to include any one-time transactions.

- Of course, the information needs of individual users may differ, requiring that the information be presented in different formats.

- According to this principle, the accountant should give the right information about the financial condition.

- Full Disclosure Principle requires the entity to disclose all necessary information in its financial statements.

Thus, companies in these industries are allowed to depart from GAAP for specific business events or transactions. This principle requires accountants to depict the actual financial situation of the organization as accurately as they could. The GAAP principles are a set of ten principles outlined by the Financial Accounting Standards Board , an independent nonprofit that sets standards for the accounting industry. Businesses that follow GAAP enjoy mutual intelligibility in their accounting, making it possible for those outside a business to easily understand its financial health. By using GAAP, other professionals can efficiently assess whether a business is a good potential partner, qualifies for loan, or carries substantial risk.

You should disclose everything relevant to a company’s finances, including all losses, pending lawsuits, potential audits, and anything else that helps provide context. The FASB’s ten standards are the basic requirements for public and business accounting in the United States, but they’re incomplete in guiding everyday accounting work.

Different Types Of Companies

IFRS rules ban the use of last-in, first-out inventory accounting methods. Both systems allow for the first-in, first-out method and the weighted average-cost method. GAAP does not allow for inventory reversals, while IFRS permits them under certain conditions. As corporations increasingly need to navigate global markets and conduct operations worldwide, international standards are becoming increasingly popular at the expense of GAAP, even in the U.S. Almost all S&P 500 companies report at least one non-GAAP measure of earnings as of 2019.

In the United States, all the numbers have to be expressed in US dollars. Companies who conduct parts of their businesses in foreign currencies have to convert the amounts in US dollars using the prevalent exchange rate while reporting their financial statements. Compliance with GAAP makes the entire financial reporting process standardized and transparent by using accepted terminology, definitions, and methodologies. The international equivalent to GAAP are the International Financial Reporting Standards, or IFRS, which are adhered to in over 120 countries.

As per this principle, a company should record the purchase of the goods, services, or capital assets at the price they actually paid for it. On the balance sheet, companies keep showing the asset at the historical without adjusting for any fluctuation in the market value. The principle suggests that an accountant must record expenses as and when they occur. On the other hand, the accountant should only record income when there is actual cash flow. This principle helps while recording transactions that are uncertain. Every company must make full disclosure and ensure that all the details and financial numbers are open to the public.

Understanding Gaap

While the two systems have different principles, rules, and guidelines, IFRS and GAAP have been working towards merging the two systems. For financial analysts performing valuation work and financial modeling, it’s important to have a solid understanding of accounting principles. While this is important, financial models focus more on cash flow and economic value, which is not significantly impacted by accounting principles . The Principle of Regularity dictates that accountants must abide by all established rules and regulations. It is this principle that establishes the mandate that all other principles and regulations set forth by GAAP must be always followed. GAAP standards maintain the trust and interest of everyone that prepares the financial statement by using the accounting standards.

Although, domestic public companies are required to follow GAAP exclusively. A lot of people rely on the financial statements issued by the government, and the GASB emphasizes transparency and equity. This project aimed to increase transparency for gifts of non-financial assets, known as “gifts-in-kind,” to not-for-profit entities. In order to do this, the board chose to require these organizations to list these donations separately from financial assets along with additional information on their valuation and use. Despite the fact that the United States government mandates the use of GAAP by public companies, it actually plays no role in creating these principles. Additionally, every state government uses GAAP in preparing their financial reports, and approximately half of these states, in turn, require county and local governments to do the same.

These principles are relevant because they provide useful information to accounting users. The accountant keeps all of the business transactions of a sole proprietorship separate from the business owner’s personal transactions. For legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate entities.

What’s The Difference Between Ifrs And U S Gaap?

This principle states that the accounting process of the company will be completed within a certain period. Thus, every transaction that takes place within that particular period of accounting must be included or can say recorded in the financial statement of the company. As per this Concept, the accounting principles and methods should remain consistent from year to year.

We Stand by our Reviews and when you Purchase something we’ve Recommended, the commissions we receive help support our Staff and our Research Process. Also, companies that want to obtain credit will need to follow GAAP. Although, the United States does not fully conform to IFRS standards. GAAP is not very easy for local or state governments to implement because their environment is different than that of most companies.

What Is The Role Of Gaap?

Therefore, if a company does not have sufficient cash rendering it unable to pay creditors, it is deemed to be in breach of the going concern principle. Conservatism is another principle under the 10 GAAP standards, and it states that accountants should immediately include potential expenses and liabilities in financial reports. A publicly-traded company can apply this principle by recognizing accounts payable immediately in their financial statements. The FASB comprises a board of seven members that participate in developing accounting standards. Establishing these rules creates uniformity in corporations’ financial statements and overall financial reporting. GAAP requires that financial statements be uniform in that the format should be uniform in all entities.

The principle of utmost good faith presumes that all parties are acting in good faith, i.e., all parties involved in the report are honest in all transactions. A financial report’s negatives and positives should be accurately represented in the report without the expectation of debt compensation or revenue. The principle of regularity refers to the adherence of the accountant to GAAP standards. – When valuing assets, the accountant should assume that the business will continue to operate. A company’s financial health must be honestly represented in its accounting. The same methods of reporting throughout the reporting process must be used and any changes must be disclosed. Reports accurately show all information, both negatives and positives, without compensation for debt by an asset or revenue by an expense.

Going Concern Principle

Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . The Securities Exchange Commission was created by the federal government and given authority The Ten Generally Accepted Accounting Principles to regulate financial markets and accounting standards boards. SEC influences GAAP by enforcing accounting standards in the context of financial statements. The SEC created the body established to set the Generally Accepted Accounting Principles.

Further, it is accepted that asset depreciation may be represented because these values change over time. This way the readers know during which period the business transactions were conducted. It does cover financial statement presentation, the financial periods to be included, and how to account for operating expenses among others. These principles are used by both private and public companies to make sure their documents are presented in an accurate, clear, and consistent way.

The system was most recently revamped in 2008 when the FASB reorganized the rules to make them easier to understand. 10 principles make up the Generally Accepted Accounting Principles, detailed below. Always seek the help of a licensed financial professional before taking action. – Both positives and negatives must be reported with full transparency. All documents that are necessary to assess the business’s finances properly must be disclosed. In legal terms, a business can exist long after the existence of its promoters or owners. Our Highly Experienced Team recommends Products or Services after thoroughly researching them to ensure we provide an unbiased, comprehensive solution for your Home or Business.

GAAP is a set of rules used for helping publicly-traded companies create their financial statements. These rules form the groundwork on which more comprehensive, complex, and legalistic accounting rules are based. GAAP helps govern the world of accounting according to general rules and guidelines. It attempts to standardize and regulate the definitions, assumptions, and methods used in accounting across all industries. GAAP covers such topics as revenue recognition, balance sheet classification, and materiality.

- The materiality principle refers to the misstatement in accounting records when the amount is insignificant or immaterial.

- The two standards treat inventories, investments, long-lived assets, extraordinary items, and discontinued operations, among others.

- These principles have evolved over many years and provide a basis for fair reporting based on best practices.

- The uniformity further enables investors to interpret the organization’s financial health.

- So, throughout this material, we will refer to different methods or different ways of doing things, procedures.

Professional judgment is needed to decide whether an amount is insignificant or immaterial. Therefore, by using the business entity concept, the accounting records for the shop is recording decreasing for stoke and increasing owner withdrawal. Without U.S. GAAP, investors and creditors would encounter significant difficulties in evaluating the financial health and future prospects of an organization3. They would face even greater uncertainty and be likely to hold on to their money or invest only in other, safer options. GAAP did not exist, the development and expansion of thousands of the businesses that have become a central part of today’s society would be limited or impossible simply because of the lack of available resources.

Any private business will also struggle to find investors or apply for loans without full GAAP compliance. The GAAP has gradually evolved, based on established concepts and standards, as well as on best practices that have come to be commonly accepted across different industries. Highlight the fact-based representation of the financial data that is not blurred by any theory or hypothecation. The accountant has to follow or stick to the GAAP rules and regulations and treat them as a Standard. There is one financial term that plays a major role in understanding accounting concepts and standards, i.e., GAAP, which is Generally Accepted Accounting Principles.

This is because if a company applies different accounting principles in two accounting periods then it will be difficult for the company to compare the profits of the current year with the preceding year. So, even when a company uses GAAP, you still need to scrutinize its financial statements. Reliability Principle is the accounting principle that concern about the reliability of financial information that presents in the financial statements of an entity. This accounting concept is quite an importance for the users of financial information. If the information is not reliable, then the decision making will be unlikely correct.

Costs of development under GAAP are to be charged to expense as they are incurred, but these costs can be amortized under IFRS. This is because IFRS standards are set by the IASB while the Financial Accounting Standards Board sets GAAP.

This principle helps the users of financial statements to get the financial information that really reflected in the current financial status or the economic situation of the entity. This principle means that the company shall be fully transparent when preparing and presenting its financial statements, and it shall report both the positives and negatives without any expectations. This principle deals in compliances as per US GAAP. It is required that all the accounts should be in compliance with US GAAP while preparing the financial statements. US GAAP is the guiding principle that deals with how the accounting should be done, and income statement and balance sheet should be prepared. In short, they’re good for small businesses while functioning as an international standard. Having some sort of consistency across reports is valuable, as it can help you and your business understand your place in the market and gives others—banks, investors, potential buyers—a clear view of your success. Principle of Materiality – All financial data should be laid out in a GAAP-compliant report.

Learn the definition of GAAP in accounting and discover its history. So the first one we’re going to talk about is what’s called the measurement principle. The measurement principle states that accounting information is based on actual value and not what we think it’s worth, not what it’s appraised for, not what it actually cost us. There are four main principles of GAAP that we follow throughout all of accounting. If it doesn’t follow one of these four principles, then it’s really not following accounting.

The ideal way to understand the GAAP requirements is the ten accounting principles. On the contrary, the International Financial Reporting Standards https://accountingcoaching.online/ are accounting guidelines recognized worldwide. Therefore, when domestic organizations become international, they have to resort to the IFRS.

How an Operating Lease Differs From a Capital Lease and Accounting for Each

The lessee on the balance sheet records the operating lease as debt liability. The lessee is required to make rent payments; therefore, the income statement is reduced by the rent expenses paid over the lease term. The lessee is renting the asset to manage the normal operation of their business. Simply put, what this means is that operating lease payments are eligible for a tax deduction (because they’re considered operating expenses), while capital lease payments are not (because they’re considered debt). The distinction between capital leases and operating leases merely comes down to whether there are ownership characteristics, which determine the presentation of the lease on the financial statements. The lessee pays periodic rental payments to the lessor for the right to use the space without assuming the risks and rewards of ownership.

- With a capital lease, you are essentially paying the cost of the car or equipment over the term of the lease.

- The depreciation of a new car being used by the business is also the car company’s loss.

- A capital lease is a contract entitling a renter to the temporary use of an asset and has the economic characteristics of asset ownership for accounting purposes.

- At that point, the determination of whether the lease is a finance lease or not must rely on the other four criteria.

- Capital lease payments reduce the liability for the lease, and the interest on lease payments is a deductible business expense.

The lease obligation’s amortization schedule reduces the $540,000 lease obligation by $36,000 so that the obligation for the second year is $504,000. The total capital lease expense is $54,000 in interest expense, plus $36,000 in lease amortization expense, for a total of $90,000. A capital lease means that both an asset and a liability are posted to the accounting records. This is an operating lease and will be recorded on the company’s balance sheet. The lessee is only renting a small portion of the building for a period substantially less than the useful life of the asset. An operating lease contract can be canceled anytime if any of the parties does not follow contract terms and conditions/rules.

New Accounting Rules for Leases

The new rules require that all leases of more than 12 months must be shown on the business balance sheet as both assets and liabilities. That’s why operating leases of less than a year are treated as expenses, while longer-term leases are treated like buying an asset. Leasing vehicles and equipment for business use is a common alternative to buying. The two kinds of leases—capital leases and operating leases—each have different effects on business taxes and accounting.

The lessee records this as a liability, whereas the lessor records this as a fixed asset on the balance sheet. Operating leases are assets rented by a business where ownership of the asset is not transferred when the rental period is complete. Typically, assets rented under operating leases include real https://www.nikepresto.us/questions-about-you-must-know-the-answers-to/ estate, aircraft, and equipment with long, useful life spans—such as vehicles, office equipment, or industry-specific machinery. For tax purposes, operating lease payments are similar to interest payments on debt; these payments are considered operating expenses on the business tax form for the year.

Advantages of a Capital Lease

The terms of a capital lease agreement show that the benefits and risks of ownership are transferred to the lessee. An operating lease is a contract that doesn’t entail any ownership of http://psychologylib.ru/books/item/f00/s00/z0000029/st009.shtml the asset. The expenses are renting expenses only as opposed to depreciation and maintenance. Therefore any depreciation and maintenance costs are the responsibility of the lessor.

- The lessee will record this as a balance sheet liability, whereas the lessor will record this as a balance sheet asset.

- Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

- You’ll record the payments as rental expenses on your income statement and benefit from any corresponding tax deductions related to renting an instrument (similarly to renting office space).

- Because the lessee who controls the asset is not the owner of the asset, the lessee may not exercise the same amount of care as if it were his/her own asset.

Either the lessee or the lessor not following the terms and conditions and rules mentioned in the lease contract would lead to before the due date termination of the lease. No – the distinction between operating and finance (previously capital) leases remains under ASC 842. If the asset is of such specialized nature it offers no alternative use after the lease term ends, then the lease is classified as finance. It’s important to determine your organization’s internal policy for each threshold of the classification criteria, document it, and follow it consistently.

Capital/Finance Lease vs. Operating Lease Explained: Differences, Accounting, & More

For accounting purposes, operating leases aren’t shown on the business balance sheet, but the lease payments are included on the business profit and loss statement. So how do these types of leases affect your income statements and balance sheets? Capital http://photoua.net/history_en.php?action=show_date&id=13 leases and operating leases appear very differently in accounting. In other words, with operating leases, you can hold onto a much larger amount of working capital, spread your costs out over time, and access the equipment you need to keep R&D going.

- For most situations, if the present value of the lease payments to be made over the lease term exceeds 90% of the fair value of the asset, then the lease is considered a finance lease.

- The distinction between capital leases and operating leases merely comes down to whether there are ownership characteristics, which determine the presentation of the lease on the financial statements.

- Consequently, accounting rules have been devised to force firms to reveal the extent of their lease obligations on their books.

- Operating leases are leases a business might use to rent assets rather than buy them outright.

- Essentially, an operating lease is a contract for a company to use an asset and return it in a similar condition to the lessor.

These leases allow businesses to use the asset without incurring the high expenses involved in purchasing it. Any taxes, insurance and maintenance costs related to the asset also go on your income statement. The key accounting difference between the two is that you record an operating lease as an expense, whereas with a finance lease, you record the object of the lease as an asset, which is subject to depreciation. However, ASC 842 includes an additional clarification that if a lease commences “at or near the end” of the economic life, then this criterion does not apply. The lessee isn’t receiving the majority of the asset’s lifetime benefit. Although it doesn’t mandate a specific threshold, ASC 842 suggests that 25% of an asset’s life may be a reasonable approach.

Everything You Need To Master Financial Modeling

While operating leases offer flexibility and off-balance sheet treatment, finance and capital leases involve on-balance sheet recognition and long-term commitments. Businesses must assess their leasing needs and financial objectives to determine the most suitable lease structure. Whether you’re making operating lease payments or capital lease payments, you’re making big investments in your business.

An operating lease on the other hand is like renting, no asset or liability is booked. In a capital lease both interest on the lease payments and depreciation of the leased asset may be recognized as expenses. In a capital lease the risks of ownership and maintenance expense fall on the lessor, while in an operating lease they fall on the lessee. Even though a capital lease is technically a sort of rental agreement, GAAP accounting standards view it as a purchase of assets if certain criteria are met. Capital leases can have an impact on companies’ financial statements, influencing interest expense, depreciation expense, assets, and liabilities.

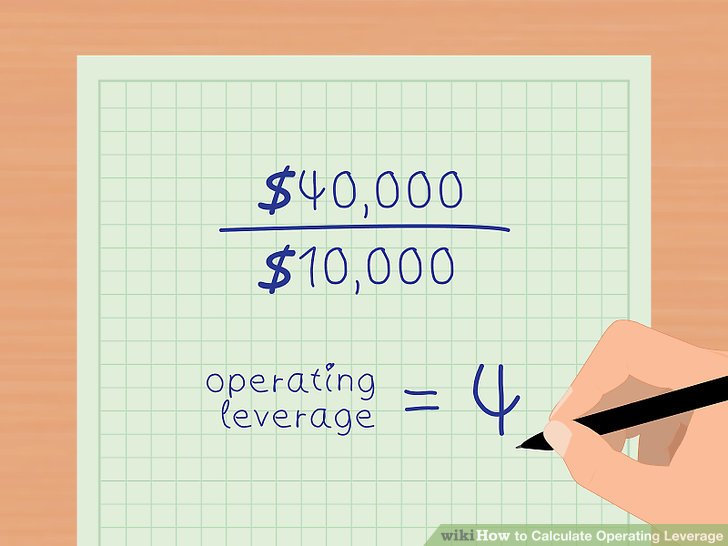

How to Perform a Cost Volume Profit CVP Analysis

In other words, this is the point of production where sales revenue will cover the costs of production. The cost volume profit chart calculates the breakeven point in revenues and units. For example, this CVP chart shows a break-even point of $52,000 in revenue and 55,000 units. The reliability of CVP lies in the assumptions it makes, including that the sales price and the fixed and variable cost per unit are constant.

The break-even point is reached when total costs and total revenues are equal, generating no gain or loss (Operating Income of $0). Business operators use the calculation to determine how many product units they need to sell at a given price point to break even or to produce the first dollar of profit. Notice how the area between the sales line and total cost line is red below the break-even and green above it. Managers can use this graph to predict the future losses if projected sales aren’t met. For example, if the company only sells $30,000 of product, its total costs will be approximately $38,000 resulting in an $8,000 loss. When creating a CVP graph, it’s important to choose a graph type that allows for the representation of both fixed and variable costs, as well as the sales volume and profits.

On a per unit basis, the contribution

margin for Video Productions is $8 (the selling price of $20 minus

the variable cost per unit of $ 12). Once the break-even point is met, additional revenue (or sales) starts to generate a profit, which is typically at least one purpose of running a business. Cost volume profit analysis allows the food service operator to calculate similar figures but with a targeted profit in mind. This CVP analysis is an essential tool in guiding managerial, financial and investment decisions for current operations or future business ideas or plans.

It has a total of 3,000 machine hours available each month. The River model requires 16 machine hours per unit, and the Sea model requires 10 machine hours per unit. However, high operating leverage companies that encounter declining sales tend to feel the negative impact more than companies with low operating leverage. Thus sales revenue can drop by $50,000 per month before the company begins to incur a loss. It is quite common for companies to want to estimate how their net income will change with changes in sales behavior. For example, companies can use sales performance targets or net income targets to determine their effect on each other.

In our case, the cost of making each sandwich (each sandwich is considered a “unit”) is $3. The most common application of CVP by financial planning and analysis (FP&A) leaders is performing break-even analysis. Put most simply, break-even analysis is calculating how many sales it takes to pay for the cost of doing business reaching a breakeven point (neither making nor losing money). Sierra Books Incorporated produces two different products with the following monthly data (this is the base case). CyclePath Company produces two different products that have the following price and cost characteristics.

As it focuses mainly on the Break-even point, it is commonly referred to as Break-even Analysis. The higher the percentage, the more of each sales dollar that is available to pay fixed costs. https://simple-accounting.org/ If the company’s contribution margin ratio is higher than the basis for comparison, the result is favorable. Break-Even Point and Target Profit Measured in Units (Single Product).

- Break-even analysis is a tool that can be used to demonstrate and calculate how much revenue is needed to make a certain amount of profit, assuming expenses remain constant.

- I recommend looking at our guide to measuring profitability for your next lesson.

- This graph can be used to identify profit at different output levels.

- Assume the sales mix remains the same at all levels of sales except for requirements i and j.

- This income statement shows us that to get the targeted income; we have to achieve the respective sales and keep variable and fixed costs at the specified levels.

Each unit of product is sold for $25 (these data are the same as the previous exercise). Assume Nellie Company expects to sell 24,000 units of product this coming month. To ensure that your graph is easily understandable, it’s essential to add labels and titles. Include a title that clearly indicates that the graph represents a cost volume profit analysis. Label the x-axis with the sales volume or quantity and the y-axis with the total costs and revenues. Additionally, label each data point with the corresponding cost or revenue amount.

Components of CVP Analysis

But we more than likely need to put a figure of sales dollars that we must ring up on the register (rather than the number of units sold). This involves dividing the fixed costs by the contribution margin ratio. Madera Company has annual fixed costs totaling $120,000 and variable costs of $3 per unit. Madera expects to sell 12,000 units this year (this is the base case). Describe the difference between absorption costing and variable costing. Which approach yields the highest profit when the units produced are greater than the units sold?